Can you maximize yield without minimizing users?

January 24, 2019

With record breaking results for Black Friday and Cyber Monday, it’s clear that the holiday shopping season is off to a robust start. Cyber Monday generated $7.9 billion in sales, up 20% over last year, setting a record for the biggest online shopping day of all time in the U.S., according to Adobe Analytics.

Similarly, Black Friday brought in over $6B in sales, an increase of 24% YoY, while Thanksgiving Day itself had the highest gain with a 28% increase in sales vs. 2017. Combined with impressive sales over the weekend (Saturday and Sunday also set a new record as the biggest online shopping weekend in the U.S.), the entire period from Thanksgiving through Cyber Monday is the most impactful 5-day span for retailers.

Which channels perform best?

Adobe is predicting that for this holiday shopping season, search will have the second highest revenue per visit (RPV) growth at 23% over last year, trailing only behind consumers that go directly to websites to make a purchase, with RVP growth of 36%.

Social traffic, on the other hand, is losing value for retailers, with 11% less RPV compared to just two years ago. It is the only marketing channel to see a decline in RPV, despite the increase in referral traffic coming from social. Adobe attributes this to consumers’ weakening trust in social networks.

How can marketers make the most of Search during periods of peak demand?

While search engines are obviously important for their scale, the problem is that pricing goes up during peak demand times like the holidays.

One way to mitigate this is to diversify search spend beyond just legacy engines and tap into new search supply that can drive truly incremental sales lift.

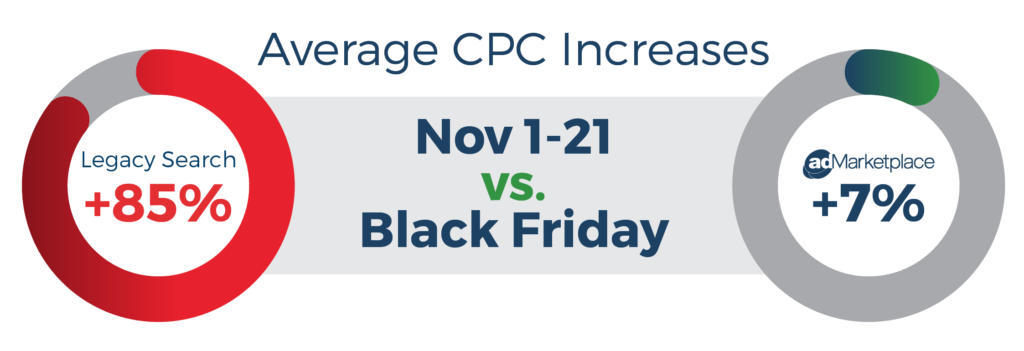

According to Kenshoo, average legacy search CPC’s nearly doubled from $0.27 during the three week ramp-up period of November 1-21 to $0.50 on Black Friday. Comparing the same time periods for adMarketplace, CPC’s rose by only 7.4%.

Native Search offers value at scale

adMarketplace has built deep integrations with publishers to deliver proprietary search supply for our advertisers at the most efficient price. As a result, when search volume and traffic increase during times like Black Friday and Cyber Monday, advertisers benefit from surging scale at a better value.

That’s just one reason why search advertisers partner with adMarketplace to drive incremental sales from consumers searching in native channels outside engines – think apps, websites, mobile browsers and browser extensions, and URL bar queries.

Cyber Monday is surpassing Black Friday

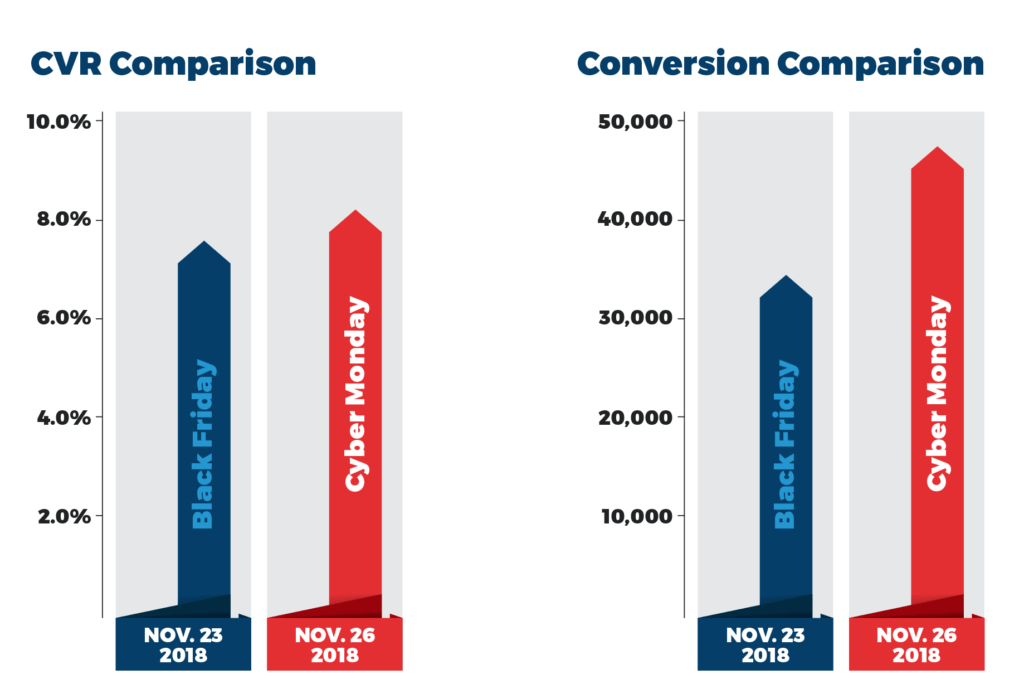

In line with results seen across the retail industry, adMarketplace advertisers saw 37% more total conversions on Cyber Monday vs Black Friday. On Cyber Monday, conversions rates were also higher than Black Friday.

Skip the SERP on the way to more sales

This year, adMarketplace launched Paid Suggest (paid search results in the search suggestion drop down box that navigate direct to advertiser landing pages) to help brands directly connect with consumers in moments of intent, avoiding the legacy search results page altogether.

Paid Suggest proved to be a particularly high converting source of traffic on Black Friday and Cyber Monday, with an average CVR of 13.1% and 12.4%, respectively, across retail, travel and consumer electronics advertisers.

Use an always-on strategy

There is a natural tendency for advertisers to add additional channels during high demand periods like the holidays. But using an always-on strategy with top performing channels throughout the year drives a consistent stream of incremental sales that you are otherwise missing out on.

As we like to say, we’re having a Cyber Monday sale on incremental search performance all year!

Click here to get in touch and start driving sales with adMarketplace native search